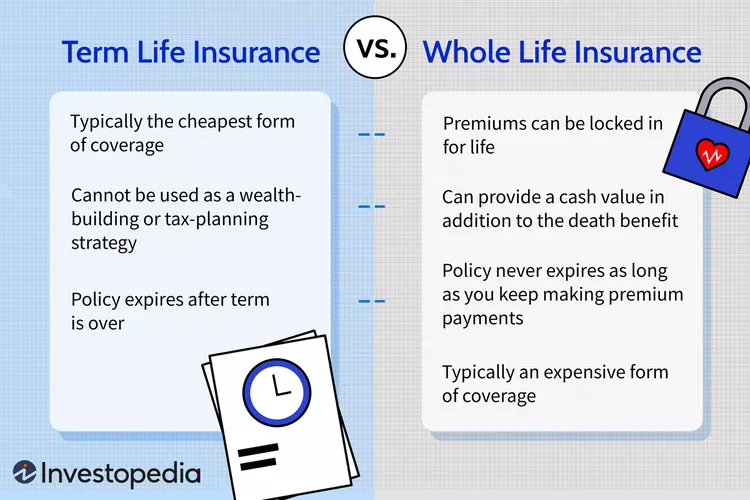

Choosing between term life insurance and whole life insurance is one of the most important financial decisions you’ll make. Both provide financial security for your loved ones, but they work in different ways:

- Term life insurance offers coverage for a set period (e.g., 10, 20, or 30 years) and is more affordable.

- Whole life insurance provides lifelong coverage and builds cash value but comes with higher premiums.

This guide will break down term life vs. whole life insurance, their costs, benefits, and which one is best for your needs.

What is Term Life Insurance?

Term life insurance provides coverage for a specific period and pays a death benefit if the policyholder passes away during that time.

What Does Term Life Insurance Cover?

✅ Death benefit to beneficiaries

✅ Temporary financial protection (e.g., covering a mortgage, children’s education)

✅ Income replacement for dependents

What Term Life Insurance Does NOT Cover

❌ No cash value accumulation

❌ No payout if the policy expires before the policyholder’s death

❌ No investment component

Term Life Insurance Cost Breakdown

| Age | $250,000 Policy | $500,000 Policy |

|---|---|---|

| 30 | $15 – $25/month | $20 – $35/month |

| 40 | $25 – $40/month | $35 – $60/month |

| 50 | $50 – $90/month | $80 – $150/month |

What is Whole Life Insurance?

Whole life insurance offers lifetime coverage and includes a cash value component that grows over time.

What Does Whole Life Insurance Cover?

✅ Death benefit to beneficiaries

✅ Guaranteed cash value accumulation

✅ Potential dividends (if from a mutual insurance company)

✅ Estate planning benefits

What Whole Life Insurance Does NOT Cover

❌ High premiums compared to term life insurance

❌ Limited investment flexibility (compared to other investment options)

❌ Cash value growth is slow in the early years

Whole Life Insurance Cost Breakdown

| Age | $250,000 Policy | $500,000 Policy |

| 30 | $150 – $250/month | $300 – $500/month |

| 40 | $250 – $400/month | $500 – $800/month |

| 50 | $400 – $700/month | $800 – $1,500/month |

Key Differences Between Term & Whole Life Insurance

| Feature | Term Life Insurance | Whole Life Insurance |

| Coverage Duration | 10-30 years | Lifetime |

| Premiums | Lower | Higher |

| Builds Cash Value | ❌ | ✅ |

| Death Benefit | Fixed | Fixed or increasing (with dividends) |

| Investment Component | ❌ | ✅ |

| Ideal For | Budget-conscious individuals | Estate planning, lifelong coverage |

Do You Need Term Life, Whole Life, or Both?

Who Needs Term Life Insurance?

- Young families needing affordable protection.

- Homeowners who want coverage for mortgage payments.

- Individuals looking for temporary income replacement.

Who Needs Whole Life Insurance?

- High-net-worth individuals seeking estate planning benefits.

- People wanting lifelong coverage with cash value growth.

- Those who prefer a forced savings component.

Who Needs Both?

- Parents who want affordable term coverage now and whole life for later estate planning.

- Business owners using whole life insurance for key person insurance.

How to Choose the Right Life Insurance Policy

Choosing Term Life Insurance

- Select a term that matches your major financial obligations (e.g., 20 years for a mortgage).

- Opt for a convertible term policy if you might want whole life later.

- Compare quotes to find the best premium rates.

Choosing Whole Life Insurance

- Ensure you can afford the long-term premiums.

- Look for participating policies if you want dividends.

- Consider it if you need tax-advantaged wealth transfer.

FAQs & Final Thoughts

FAQs

1. Can I convert term life insurance to whole life insurance?

Yes, many term policies allow conversion without a medical exam.

2. Is whole life insurance worth it?

It depends—whole life is ideal for long-term financial planning, but not for short-term affordability.

3. What happens if my term life policy expires?

If you outlive your term policy, you don’t get a payout unless you renew or convert it.

Final Thoughts

- Term life insurance is affordable, temporary coverage for income protection.

- Whole life insurance offers lifetime coverage with cash value growth.

- Many people start with term life and later convert to whole life.

Need a life insurance quote? Compare policies today and secure your family’s future!